Crude oil prices took a breather last week, leaving WTI little changed by Friday. This meant a pause after weeks of consistent gains. Recent data shows that there has been a cautious increase in upside exposure in crude oil.

Crude Oil Sentiment Outlook – Bearish

Only 36% of retail traders are net-long crude oil. Since most of them are biased to the downside, this continues to suggest that prices may rally down the road. That said, upside exposure has increased by 7.73% and 1.81% from the last trading day and one week ago, respectively. With that in mind, recent changes in positioning hint that prices might soon reverse lower ahead.

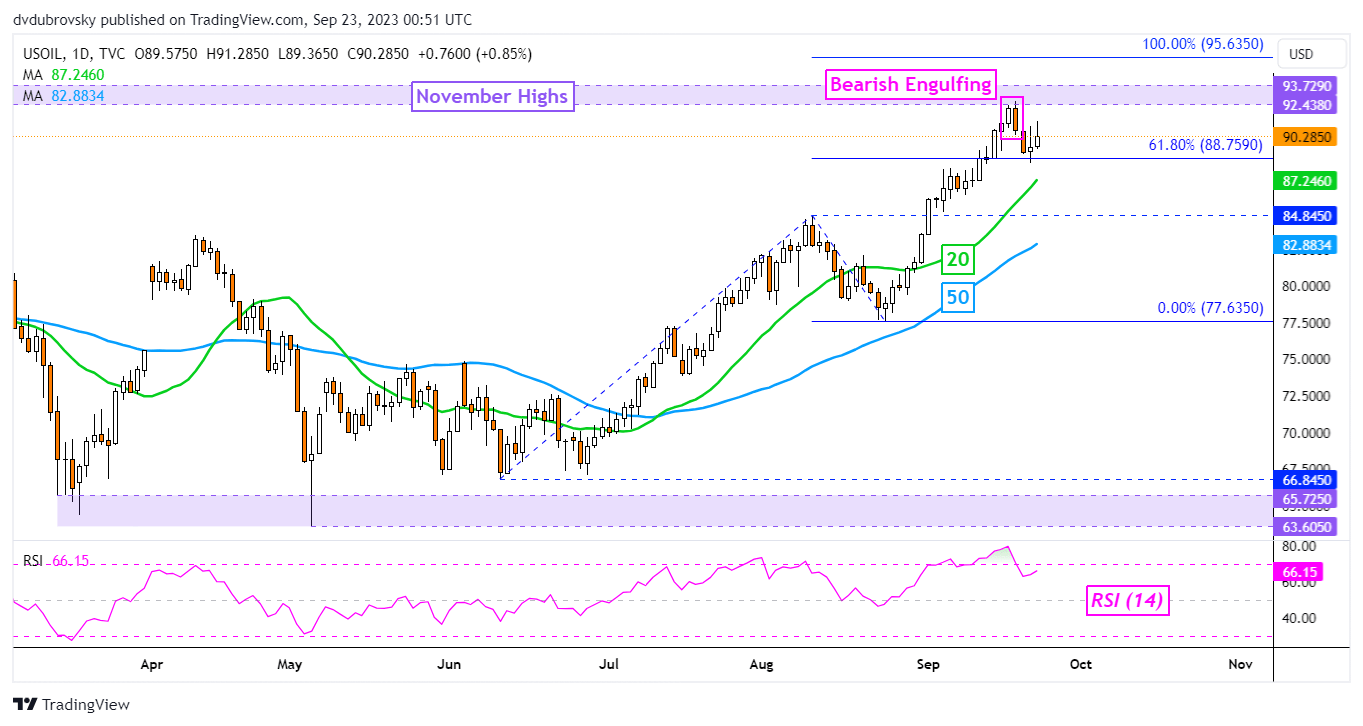

On the daily chart below, WTI has pushed higher over the past 48 hours (trading days). This is somewhat undermining the emergence of a Bearish Engulfing from last week. This followed a rejection of the 61.8% Fibonacci extension level of 88.75, where support was reinforced. As such, this is leaving a neutral technical setting in the very short term.

Key resistance is the 92.43 – 93.72 range, made up of highs from November. Meanwhile, the 20-day Moving Average is creeping higher. The latter may hold as support, maintaining the upside technical bias. Otherwise, a breakout below it subsequently places the focus on the 84.84 inflection zone.