Overview of Nifty50

The Nifty50 index, representing the top 50 companies listed on the National Stock Exchange of India, is a significant benchmark for traders and investors. It provides a snapshot of the overall market performance, making it a crucial tool for anticipating market movements.

Current Market Conditions

This week, the Nifty50 exhibited a mixed trend with fluctuations driven by global economic indicators, corporate earnings reports, and macroeconomic factors. Market participants should keep an eye on international market developments and domestic economic data releases, which are likely to influence volatility in the coming days.

Key Support and Resistance Levels

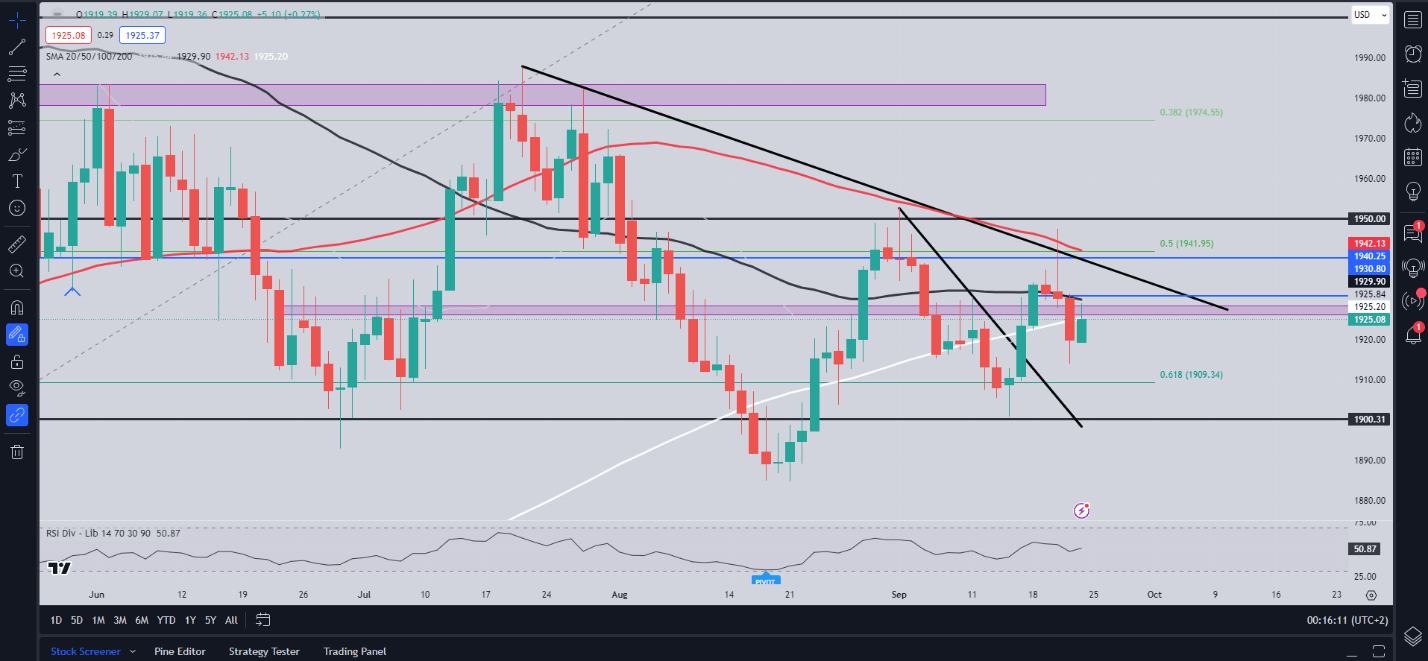

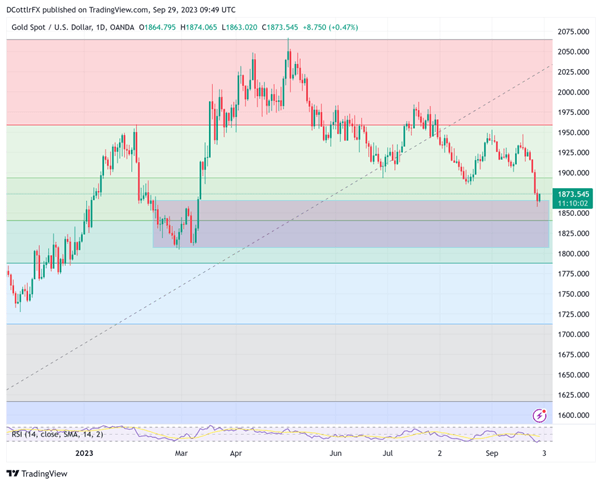

As of the latest data, key support levels for Nifty50 are observed around 17,800 points, while resistance is gauged at approximately 18,200 points. Traders should monitor these levels closely, as breaches could indicate significant market shifts, creating potential trading opportunities.

Technical Indicators to Watch

Technical indicators such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands suggest a cautious trading approach. The RSI, in particular, indicates the index is approaching an oversold region, suggesting potential for a short-term rebound.

Trading Strategies

In such a dynamic market environment, traders may consider adopting a balanced approach. Swing trading could be effective for capitalizing on short-term market fluctuations. Conversely, position trading strategies might benefit those looking to hold onto investments for an extended period, anticipating broader market trends.

Ultimately, staying informed and employing a disciplined trading strategy are key to navigating the Nifty50’s weekly forecast and trend analysis. By keeping an eye on market indicators and economic developments, traders can better position themselves to make educated trading decisions.